Characteristics Of Scholarships

Characteristics Of Scholarships - Here, we survey the current blockchain ecosystem, identifying 39 organizations that are developing blockchain solutions for carbon markets across four use cases: Robust, trustful, and secure voluntary carbon markets are therefore needed to allow offsetting emissions by purchasing carbon credits. Carbon markets, in their essence, are trading systems where carbon credits → representing a tonne of co2 equivalent reduced or removed from the atmosphere → are. Anyone can acquire klima or through the open, transparent, and fairly priced markets that are hosted on decentralized finance (defi) exchanges such as sushiswap. Voluntary carbon markets allow carbon emitters to. The shift toward decentralized control is particularly evident in the cases of tokenized real estate, bonds, and carbon credits, where token holders have a direct role in. By including previously excluded individuals into the voluntary carbon offset marketplace, we are disrupting and democratizing this $10 billion (growing to $2.2 trillion over the next 15 years). The carbon credit marketplace is a decentralized application (dapp) built on the neo x blockchain, utilizing smart contracts to facilitate the trading of carbon credits. The shift toward decentralized control is particularly evident in the cases of tokenized real estate, bonds, and carbon credits, where token holders have a direct role in. Robust, trustful, and secure voluntary carbon markets are therefore needed to allow offsetting emissions by purchasing carbon credits. Anyone can acquire klima or through the open, transparent, and fairly priced markets that are hosted on decentralized finance (defi) exchanges such as sushiswap. Carbon markets, in their essence, are trading systems where carbon credits → representing a tonne of co2 equivalent reduced or removed from the atmosphere → are. By including previously excluded individuals into the voluntary carbon offset marketplace, we are disrupting and democratizing this $10 billion (growing to $2.2 trillion over the next 15 years). Here, we survey the current blockchain ecosystem, identifying 39 organizations that are developing blockchain solutions for carbon markets across four use cases: Voluntary carbon markets allow carbon emitters to. The carbon credit marketplace is a decentralized application (dapp) built on the neo x blockchain, utilizing smart contracts to facilitate the trading of carbon credits. Anyone can acquire klima or through the open, transparent, and fairly priced markets that are hosted on decentralized finance (defi) exchanges such as sushiswap. Robust, trustful, and secure voluntary carbon markets are therefore needed to allow offsetting emissions by purchasing carbon credits. Carbon markets, in their essence, are trading systems where carbon credits → representing a tonne of co2 equivalent. Anyone can acquire klima or through the open, transparent, and fairly priced markets that are hosted on decentralized finance (defi) exchanges such as sushiswap. Robust, trustful, and secure voluntary carbon markets are therefore needed to allow offsetting emissions by purchasing carbon credits. Carbon markets, in their essence, are trading systems where carbon credits → representing a tonne of co2 equivalent. Voluntary carbon markets allow carbon emitters to. The shift toward decentralized control is particularly evident in the cases of tokenized real estate, bonds, and carbon credits, where token holders have a direct role in. Carbon markets, in their essence, are trading systems where carbon credits → representing a tonne of co2 equivalent reduced or removed from the atmosphere → are.. Carbon markets, in their essence, are trading systems where carbon credits → representing a tonne of co2 equivalent reduced or removed from the atmosphere → are. Robust, trustful, and secure voluntary carbon markets are therefore needed to allow offsetting emissions by purchasing carbon credits. Anyone can acquire klima or through the open, transparent, and fairly priced markets that are hosted. The shift toward decentralized control is particularly evident in the cases of tokenized real estate, bonds, and carbon credits, where token holders have a direct role in. Anyone can acquire klima or through the open, transparent, and fairly priced markets that are hosted on decentralized finance (defi) exchanges such as sushiswap. Voluntary carbon markets allow carbon emitters to. The carbon. Voluntary carbon markets allow carbon emitters to. The carbon credit marketplace is a decentralized application (dapp) built on the neo x blockchain, utilizing smart contracts to facilitate the trading of carbon credits. The shift toward decentralized control is particularly evident in the cases of tokenized real estate, bonds, and carbon credits, where token holders have a direct role in. Carbon. By including previously excluded individuals into the voluntary carbon offset marketplace, we are disrupting and democratizing this $10 billion (growing to $2.2 trillion over the next 15 years). Robust, trustful, and secure voluntary carbon markets are therefore needed to allow offsetting emissions by purchasing carbon credits. Here, we survey the current blockchain ecosystem, identifying 39 organizations that are developing blockchain. By including previously excluded individuals into the voluntary carbon offset marketplace, we are disrupting and democratizing this $10 billion (growing to $2.2 trillion over the next 15 years). Anyone can acquire klima or through the open, transparent, and fairly priced markets that are hosted on decentralized finance (defi) exchanges such as sushiswap. Here, we survey the current blockchain ecosystem, identifying. Carbon markets, in their essence, are trading systems where carbon credits → representing a tonne of co2 equivalent reduced or removed from the atmosphere → are. Anyone can acquire klima or through the open, transparent, and fairly priced markets that are hosted on decentralized finance (defi) exchanges such as sushiswap. Voluntary carbon markets allow carbon emitters to. Robust, trustful, and. Here, we survey the current blockchain ecosystem, identifying 39 organizations that are developing blockchain solutions for carbon markets across four use cases: By including previously excluded individuals into the voluntary carbon offset marketplace, we are disrupting and democratizing this $10 billion (growing to $2.2 trillion over the next 15 years). The shift toward decentralized control is particularly evident in the. Here, we survey the current blockchain ecosystem, identifying 39 organizations that are developing blockchain solutions for carbon markets across four use cases: Carbon markets, in their essence, are trading systems where carbon credits → representing a tonne of co2 equivalent reduced or removed from the atmosphere → are. By including previously excluded individuals into the voluntary carbon offset marketplace, we are disrupting and democratizing this $10 billion (growing to $2.2 trillion over the next 15 years). Robust, trustful, and secure voluntary carbon markets are therefore needed to allow offsetting emissions by purchasing carbon credits. The carbon credit marketplace is a decentralized application (dapp) built on the neo x blockchain, utilizing smart contracts to facilitate the trading of carbon credits. Anyone can acquire klima or through the open, transparent, and fairly priced markets that are hosted on decentralized finance (defi) exchanges such as sushiswap.U.S. Scholarship Statistics The Latest Data, Facts And Costs

U.S. Scholarship Statistics The Latest Data, Facts And Costs

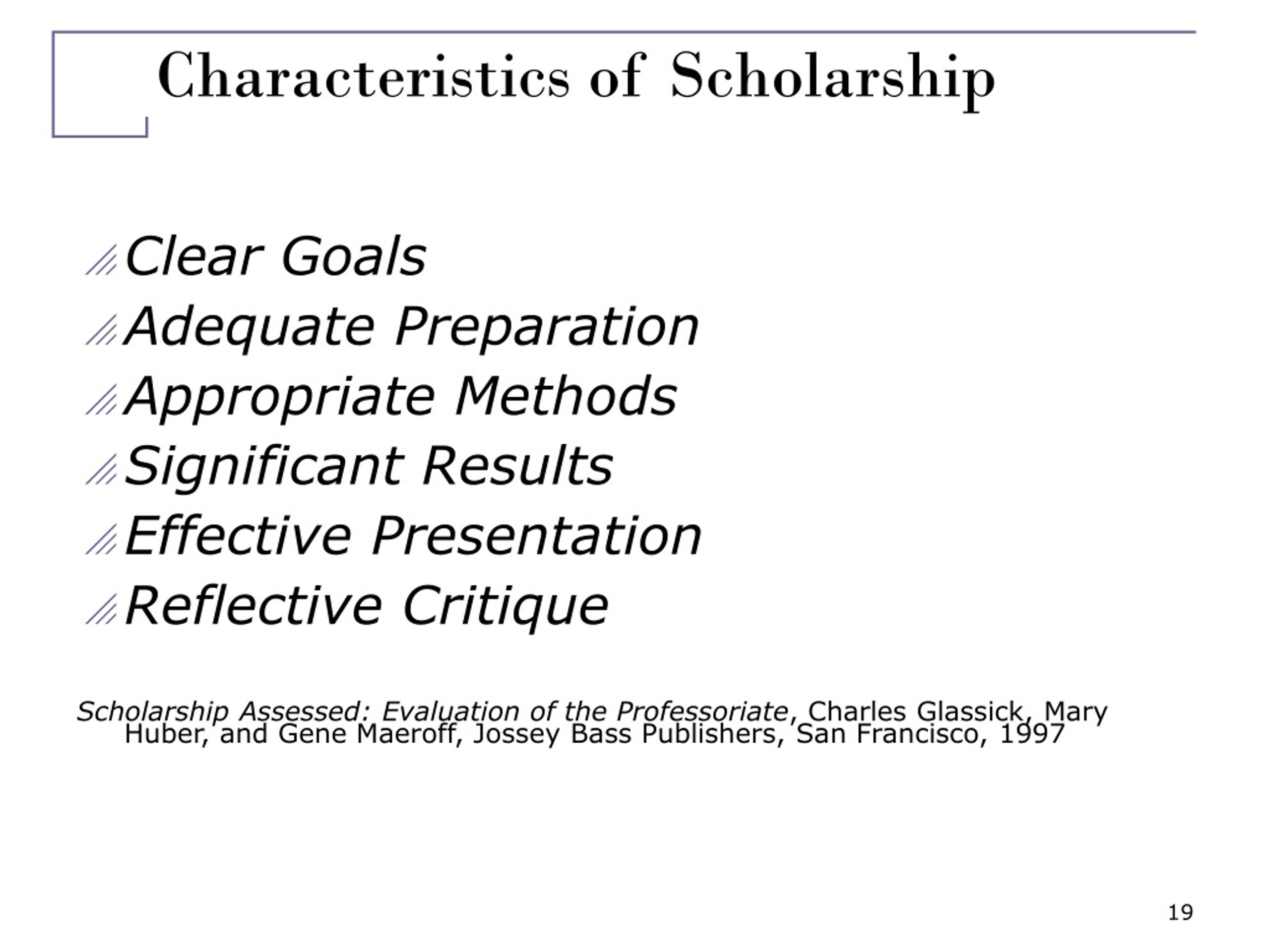

PPT Building a Disciplinary Commons using Course Portfolios

Study Scholarship What makes the Difference?

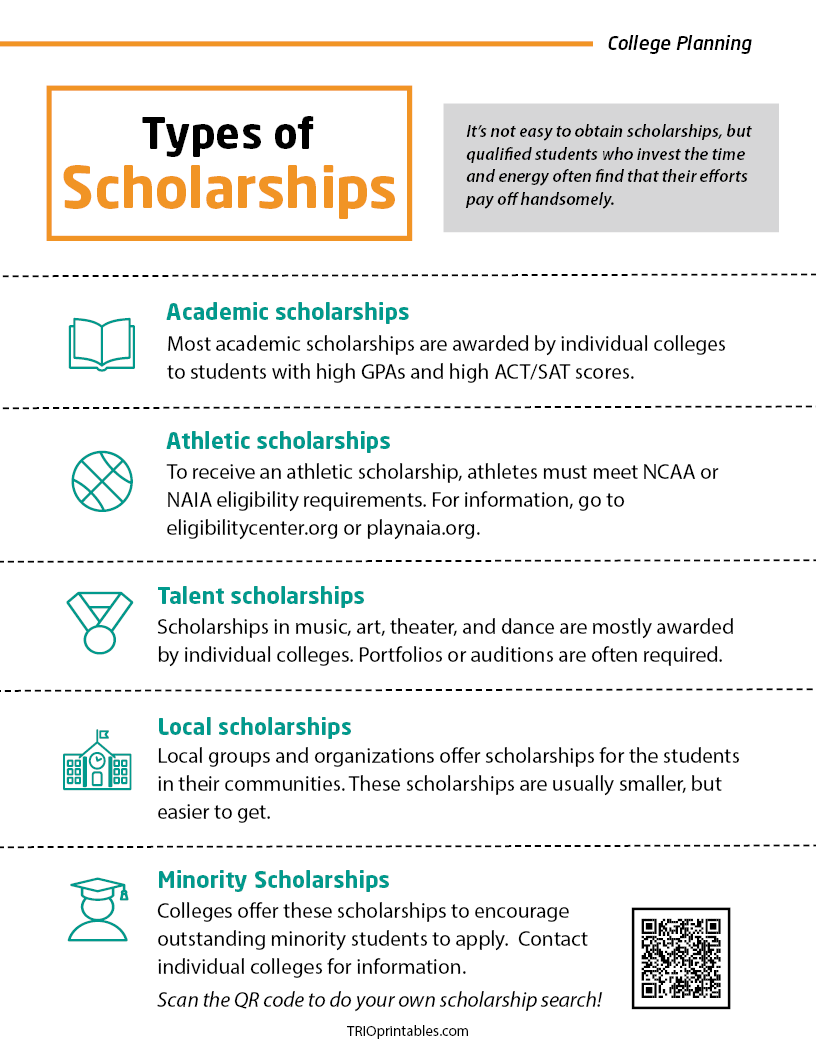

The Complete Guide on the Different Types of Scholarships

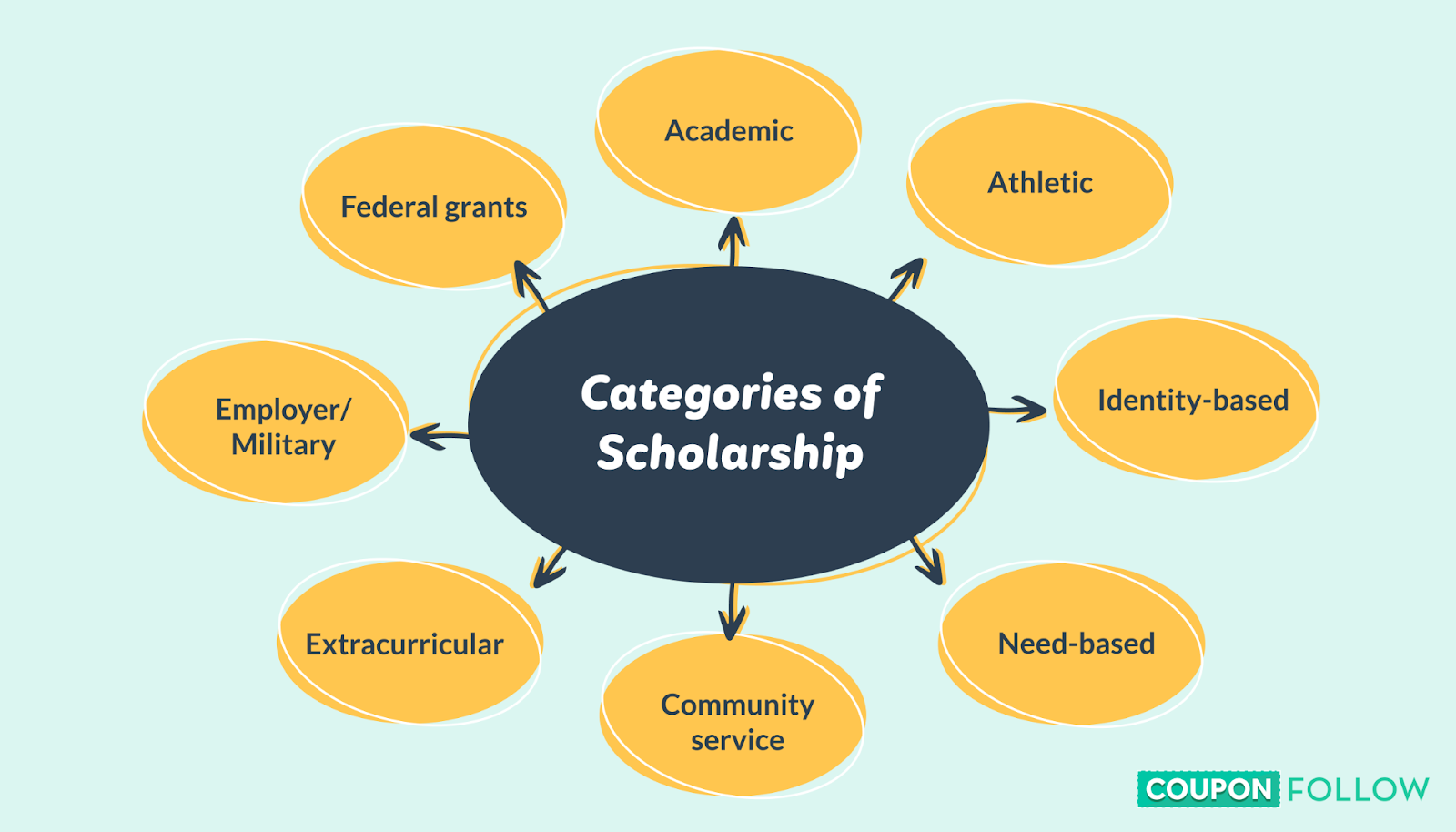

Different Types of Scholarships and How You Can Qualify Uloop

Types of Scholarships Informational Sheet TRIO Printables

The Ultimate Guide to Landing a Scholarship CouponFollow

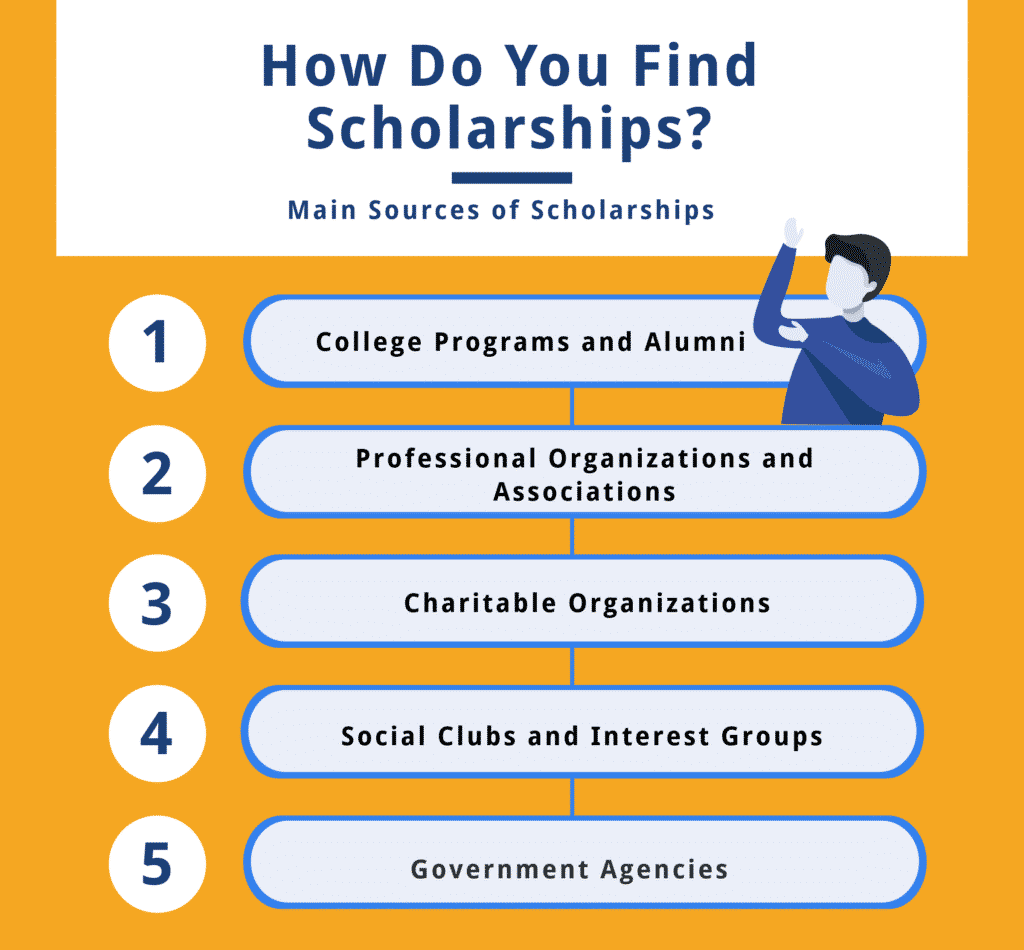

Everything We Know About Applying For Scholarships

Scholarships

The Shift Toward Decentralized Control Is Particularly Evident In The Cases Of Tokenized Real Estate, Bonds, And Carbon Credits, Where Token Holders Have A Direct Role In.

Voluntary Carbon Markets Allow Carbon Emitters To.

Related Post: