501C3 Scholarships

501C3 Scholarships - Unsure if your nonprofit qualifies for 501(c)(3) status? The name comes from section 501 (c) (3) of the. In reality, an organization could be one of those, all of those, or somewhere in. 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. Eine 501 (c) organization (kurz: Learn the requirements and costs of setting up a 501(c)(3). Nonprofit, charity, exempt organization, and 501 (c) (3). A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. What is a 501 (c) (3) nonprofit organization? A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. In reality, an organization could be one of those, all of those, or somewhere in. Eine 501 (c) organization (kurz: Many people use these terms interchangeably: A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. What is a 501 (c) (3) nonprofit organization? Nonprofit, charity, exempt organization, and 501 (c) (3). 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. The name comes from section 501 (c) (3) of the. Unsure if your nonprofit qualifies for 501(c)(3) status? A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. Unsure if your nonprofit qualifies for 501(c)(3) status? What is a 501 (c) (3) nonprofit organization? 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. The name comes from section 501 (c) (3) of the. Eine 501 (c) organization (kurz: Learn the requirements and costs of setting up a 501(c)(3). Nonprofit, charity, exempt organization, and 501 (c) (3). Many people use these terms interchangeably: A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. The name comes from section. A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. In reality, an organization could be one of those, all of those, or somewhere in. Eine 501 (c) organization (kurz: Learn the requirements and costs of setting up a 501(c)(3). The name comes from section 501 (c) (3) of the. Nonprofit, charity, exempt organization, and 501 (c) (3). A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. Eine 501 (c) organization (kurz: Many people use these terms interchangeably: In reality, an organization could be one of those, all of those, or somewhere in. The name comes from section 501 (c) (3) of the. What is a 501 (c) (3) nonprofit organization? Eine 501 (c) organization (kurz: A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. Learn the requirements and costs of. Unsure if your nonprofit qualifies for 501(c)(3) status? The name comes from section 501 (c) (3) of the. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. A 501 (c) (3) nonprofit organization is generally a business entity. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. Nonprofit, charity, exempt organization, and 501 (c) (3). Eine. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. Learn the requirements and costs of setting up a 501(c)(3). Many people use these terms interchangeably: In reality, an organization could be one of those, all of those, or. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. Many people use these terms interchangeably: Unsure if your nonprofit qualifies for 501(c)(3) status? Learn the requirements and costs of setting up a 501(c)(3). The name comes from section. 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. Many people use these terms interchangeably: Eine 501 (c) organization (kurz: Unsure if your nonprofit qualifies for 501(c)(3) status? The name comes from section 501 (c) (3) of the. 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. Eine 501 (c) organization (kurz: In reality, an organization could be one of those, all of those, or somewhere in. What is a 501 (c) (3) nonprofit organization? The name comes from section 501 (c) (3) of the. Nonprofit, charity, exempt organization, and 501 (c) (3). Unsure if your nonprofit qualifies for 501(c)(3) status?York Energy Solutions Foundation Inc 501c3 on LinkedIn The YES

Choosing a NonProfit vs an LLC in Biotech Research

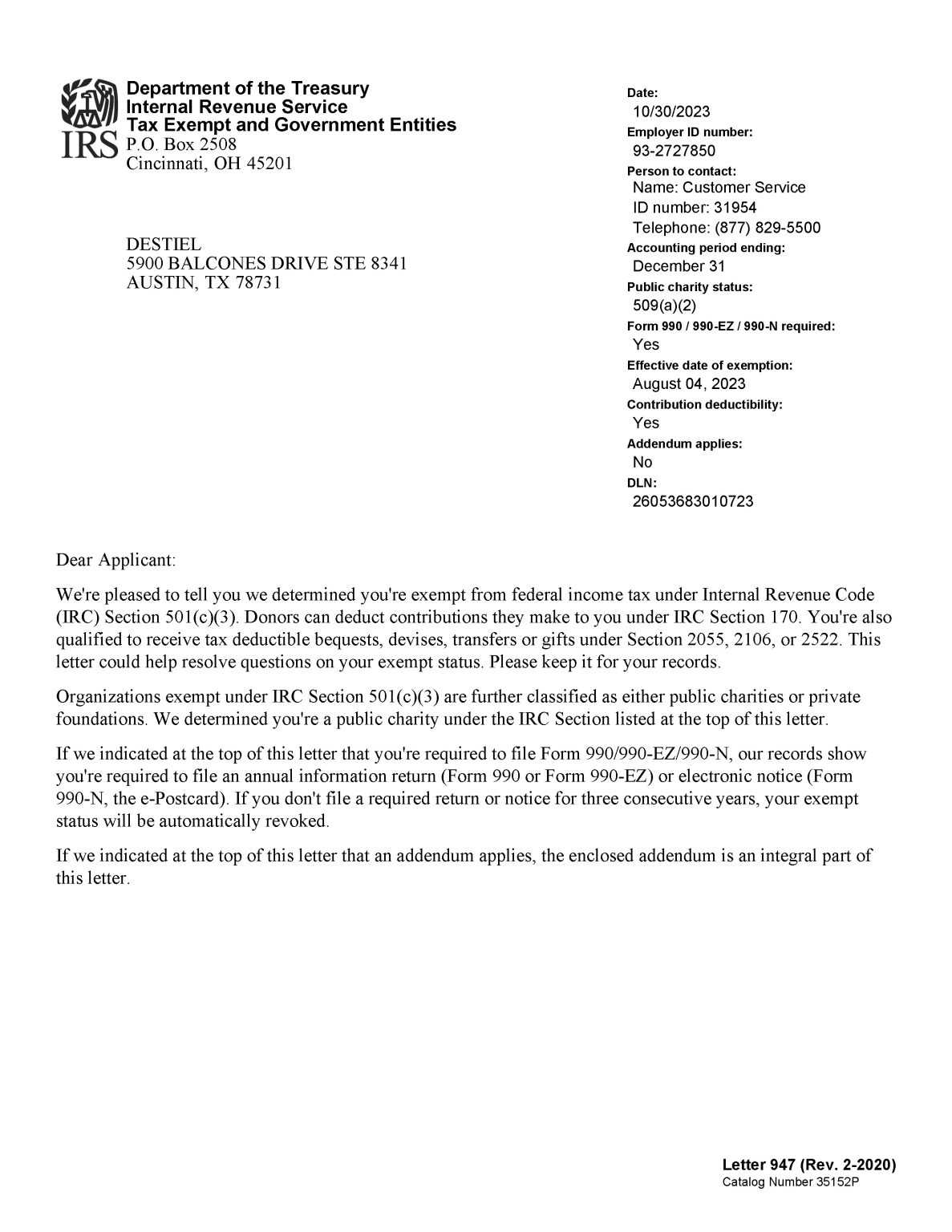

501(c)(3) IRS Determination Letter Destiel

501c3 scholarship financialaid community stlouis Philip McRae

Miss Vermont’s Teen Awards First Scholarship from her 501c3 Defying

Scholarships The St. Louis American Foundation

Ajilla The Ajilla Foundation Scholarship is Now Open! At the Ajilla

fellowship scholarship payingitforward bayarfellowship ivyleague

Scholarships The St. Louis American Foundation

We reached 501c3 status and support low carbon and energy Society for

Learn The Requirements And Costs Of Setting Up A 501(C)(3).

A 501 (C) (3) Organization Is A United States Corporation, Trust, Unincorporated Association, Or Other Type Of Organization Exempt From Federal Income Tax Under Section 501 (C) (3) Of Title 26.

Many People Use These Terms Interchangeably:

Related Post: